- October 1, 2020

- adminym

- 0

Why use a corporate service provider when I can do it myself?

Companies in Singapore follow a number of statutory guidelines that enable a healthy business environment for them to thrive well in. Appointing a resident corporate secretary, filing taxation documents and keeping accounting records for regular auditing are some of the obligations that a company needs to fulfil.

These tasks can be performed by the company itself, but they are detailed, tedious, and time-consuming. Often, the time spent by a company on these tasks can be better translated into goal-driven work that profits and adds value to the company – the time spent on these tasks are not worth it for a company. Companies benefit from outsourcing these services to a corporate service provider, allowing the company to focus on important company goals.

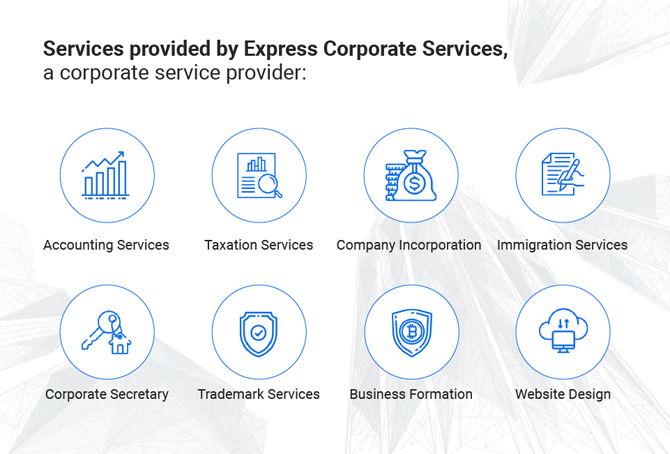

A corporate service provider provides service solutions to companies in these tasks – be it taxation, accounting, company incorporation, or corporate secretarial support – all these services are managed expertly through professionals and thoughtful practices.

If you are considering whether or not to engage a corporate service provider, here are some benefits you can consider:

1. Takes care of compliance deadlines

There are many deadlines under the Companies Act that a company in Singapore needs to keep. Companies have to hold Annual General Meetings (AGM) and file key documents like the Annual Returns (AR), Estimated Chargeable Income (ECI) and corporate tax returns within a given timeframe, and lodge documents to inform of any changes to the company’s registered business address or company directors.

Managing the different deadlines can be an overwhelming task, but engaging a corporate service provider eases this burden by helping you to manage all compliance deadlines – monitoring each task and updating you in the process.

2. Avoid penalties

Along with statutory obligations are the many penalties that a company will suffer if it does not keep to necessary deadlines. When deadlines are breached, companies have to pay late lodgement fees, and these fees can add up to huge amounts, incurring unnecessary costs for the company. A corporate service provider helps you to file all necessary documents on time and avoid unnecessary fines and penalties.

3. Saves time

For any business, time is of the essence. Compliance are arduous and long-standing tasks and distract companies from priority tasks that profit the business. Corporate service providers help you deal efficiently with your lawful obligations, leaving your business greater room for growth.

4. One-stop easy solution

From the incorporation of your company to the accounting, taxation and secretarial services, you can count on your corporate service provider to cover all of your company’s bases without having to deal with each need separately. Look forward to the seamless integration of all obligated business tasks when you engage a service provider rather than do-it-yourself!

5. Walks foreigners through international incorporation

Foreign companies who are looking to incorporate in Singapore cannot do the incorporation process on their own but need the help of a corporate service provider to file their documents on their behalf. A corporate service provider can easily walk you through each step and requirement, like applying for a work pass to Singapore, appointing a resident director and secretary, filing for the transfer of directorship once you secure your work pass etc.

Overall, it is possible for companies to handle all necessary tasks on their own, but a corporate service provider manages all needed tasks professionally and efficiently, freeing companies to dive determinedly into building a flourishing business.

Engage Express Corporate Services for professional services at competitive rates here.